Why Your Personal and Business Credit Ratings Matter More Than Ever

When it comes to securing financing — whether it’s a personal loan, a mortgage, or a commercial real estate loan — your credit rating is one of the first things lenders look at. Both your personal credit score and your business credit rating play a critical role in determining whether you get approved, how much you can borrow, and what interest rate you’ll pay.

What is a Personal Credit Score?

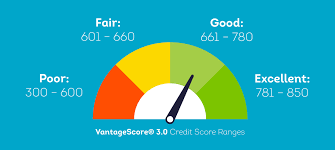

Your personal credit score is a number that reflects how you’ve managed credit over time. In Canada and the U.S., it typically ranges from 300 to 900. The higher the score, the more confidence lenders have in your ability to repay debt.

Key factors that impact your personal credit score:

- Payment history (on-time or late payments)

- Credit utilization (how much of your available credit you’re using)

- Length of credit history

- Types of credit (credit cards, loans, lines of credit)

- Recent inquiries (how often you apply for credit)

Maintaining a strong personal credit score shows banks, mortgage lenders, and private investors that you are financially responsible.

What is a Business Credit Rating?

If you operate a company, your business credit rating is just as important as your personal score — especially when seeking commercial loans or business financing. It measures your company’s ability to meet financial obligations, and lenders use it to assess risk when you apply for funding.

Key factors that impact your business credit rating:

- Payment performance to vendors, suppliers, and lenders

- Outstanding debt obligations

- Company financial statements (revenue, profit, cash flow)

- Public records (liens, judgments, bankruptcies)

- Business longevity and industry risk

Strong business credit makes it easier to secure commercial mortgages, equipment financing, and lines of credit at better rates and terms.

Why Both Credit Ratings Matter

Lenders often review both your personal and business credit. Why? Because many entrepreneurs personally guarantee loans for their businesses. If your company’s credit is thin or weak, your personal score can tip the scales.

For example:

- A developer applying for a land development loan will be assessed not just on the project’s feasibility, but also on their personal credit score and the company’s business credit rating.

- A small business owner seeking a line of credit may need a strong personal profile to supplement limited business history.

Tips to Improve Your Creditworthiness

- Pay bills on time — even one late payment can lower your score.

- Keep utilization low — aim to use less than 30% of available credit.

- Separate personal and business credit — use business credit cards and loans for company expenses.

- Check your credit regularly — monitor both personal and business credit reports for errors.

- Build relationships with lenders — a history of responsible borrowing builds trust.

The Bottom Line

In today’s financing environment, your personal credit score and business credit rating are more than just numbers — they’re a reflection of your credibility and financial discipline. Whether you’re applying for a mortgage, business loan, commercial real estate financing, or a line of credit, these scores can mean the difference between approval and rejection.

At The Coterie Group, we specialize in helping clients strengthen their credit position and structure deals that succeed — even when the situation is complex.

👉 Ready to explore funding options? Contact us today to see how we can help.