Working On

-

Premium Mineral Water Company – Serbia (Swiss-Owned)

This is a unique opportunity to acquire a Swiss-controlled, fully operational premium mineral water production facility located in Serbia, South-East Europe. The site boasts one of the largest bottling capacities in the region at 300 million bottles per year, with a modern facility and high-grade, nitrate-free artesian water source certified safe for infants.

Investment Highlights:

- Location: Serbia (South-East Europe)

- Asking Price: €18 million, debt-free (enterprise value)

- Facility: Built to Swiss industrial standards (2016–2018), includes land, buildings, PET & glass bottling lines, warehousing, and full utility and logistics infrastructure.

- Water Source: Perpetual extraction license, deep artesian, low nitrate, naturally replenished, EU/WHO compliant.

- Production Potential: 300+ million bottles/year, glass bottle and PET lines; break-even at just 11 million bottles.

- History: Acquired by current owners in 2017, major capex in 2018–2019, strong launch, maintained through COVID, stabilized for sale in 2025.

Highlights for Buyers:

- Turnkey asset ready for immediate scale-up—minimal additional CAPEX needed.

- Certified for export, suitable for premium and baby niches (HORECA, airlines, hospitality, retail).

- Rare chance for a strategic beverage or investment group to enter or expand in the Balkan/EU water market with Swiss-quality production.

-

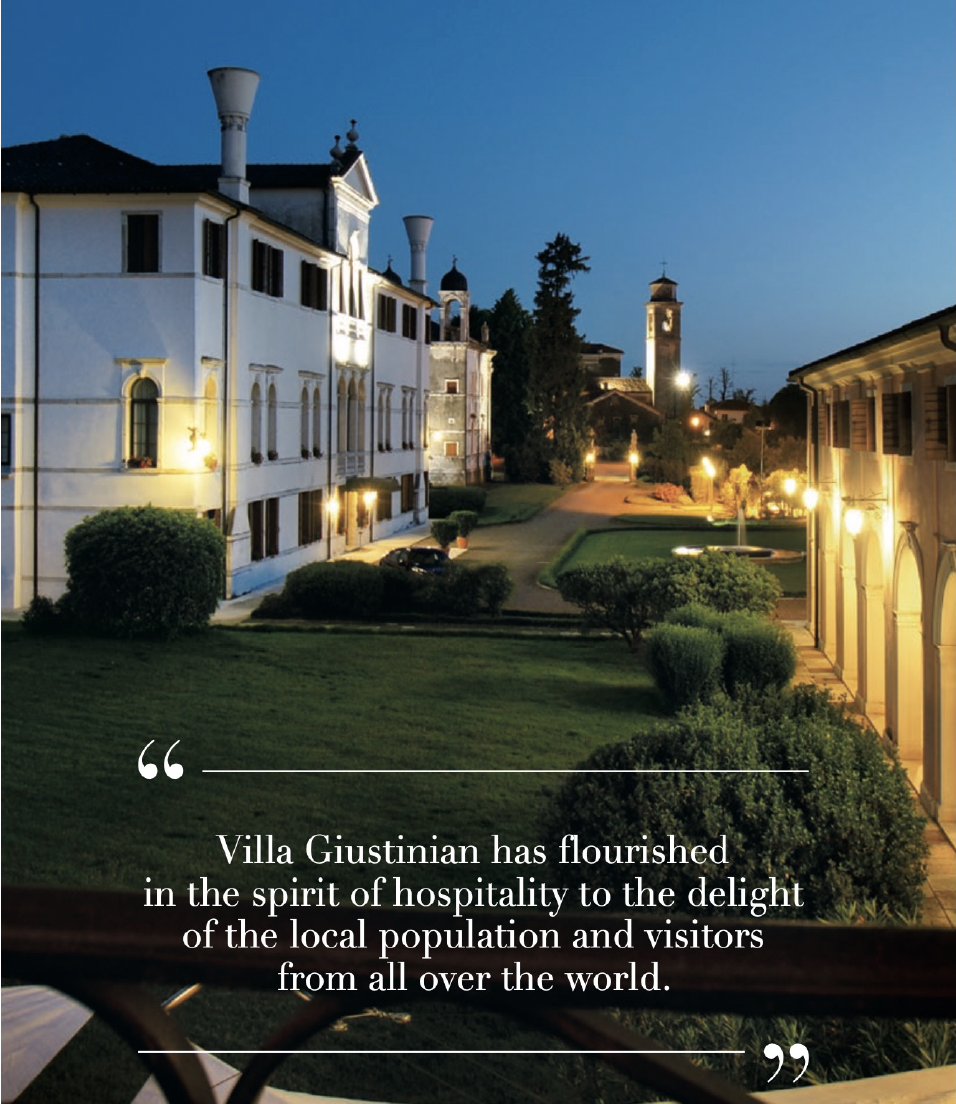

For Sale: Villa Giustinian – Italy

Historic Venetian Villa & Estate Near Venice, Italy

Price and Inquiries:

Contact us for price and confidential sale details.Location:

Set in the charming medieval village of Portobuffolè, Treviso province, just a short drive from Venice and Treviso, and within easy reach of Conegliano Veneto and the Prosecco region.History & Prestige:

Villa Giustinian stands as a magnificent 17th-century Venetian villa, renowned since its completion in 1695 as one of the grandest country estates between Friuli-Venezia Giulia and Veneto. Originally commissioned by Alessandro Cellini, heir to a wealthy merchant dynasty, the villa has housed nobility, served as a hospital and orphanage during the two world wars, and was lovingly restored in the late 20th century under the supervision of Venetian heritage authorities. The property carries centuries of Venetian heritage and has flourished as a place of warm hospitality.Estate & Land:

- Private park: Approximately 4.5 hectares (11 acres) of beautifully landscaped grounds and gardens with classical statues, rare mature trees, and a large outdoor swimming pool (23.5 x 8 meters).

- Main Villa: ~1,400 m², featuring 8 luxurious suites, grand frescoed halls (with scenes attributed to the school of Veronese), banquet room, breakfast room, and fine period details.

- Barchessa (Annex): ~2,600 m², with an additional 35 rooms and suites, conference/banquet rooms, a restaurant (250-seat capacity), wine bar (enoteca), and modern amenities.

- Additional facilities: Multipurpose event spaces (up to 350 guests), ample parking, outdoor pool, Italianate gardens, private chapel, and original cellars.

Current Use & Potential:

Currently operated as a prestigious 4-star hotel and events estate, Villa Giustinian is ideal for conversion as a private residence, luxury boutique hotel, exclusive retreat, or international corporate venue.Highlights:

- Meticulously restored interiors with breathtaking frescoes and stuccoes.

- Freehold property—rare opportunity in the Veneto region.

- Strategically positioned for tourism, wine, and cultural routes—surrounded by some of Italy’s most beautiful towns and landscapes.

- Rich with history and architectural splendor, yet tailored to modern hospitality or private enjoyment.

Contact us today to receive a detailed brochure, arrange a confidential tour, or discuss acquisition terms for this iconic Venetian estate. Villa Giustinian truly offers an unmatched blend of history, luxury, and opportunity in the heart of northern Italy.

-

Investment Opportunity – Spain

Seeking 300,000 Euro’s

We are seeking a partner or lender to help close the land acquisition and launch “New Beginnings” – a world-class wellness retreat and personal development center in the heart of Andalusia. We are looking to raise €300,000 (loan or partnership) to secure the property and begin development.

Project highlights:

- 29 hectares of sun-soaked land just outside Málaga

- Approved for expansive wellness facilities, hotel rooms, and natural-lodge accommodations

- Private water source, panoramic views, unique microclimate

- Focus: wellness retreats, personal development, holistic health, relaxation & beauty

- Premium positioning in Europe’s booming health and wellness sector

If you want to be part of an inspiring project with clear growth, solid margins, and strong market fundamentals, let’s connect! Full information, projections, and business plan available upon request.

-

Penthouse Hollywood – FL – USA

Seeking $6M USD

Presenting a prestigious penthouse residence in the renowned Trump Hollywood building on Ocean Drive, Hollywood Beach, Florida. This “mansion in the sky” offers exceptional oceanfront views, expansive living spaces, and exquisite designer finishes—all in one of Miami’s most sought-after luxury towers.

The property features five-star amenities including oceanfront pools, tennis courts, state-of-the-art spa and fitness center, private cabanas, and concierge service. Currently leased, the penthouse generates robust rental income. The ownership structure is a trust, and we are seeking to refinance the asset to support strategic financial objectives.

This represents a blue-chip luxury opportunity with proven market appeal and enduring value in an iconic beachfront setting.

-

Shopping Center – Marbella Spain

For Sale €8,000,000

FOR SALE: Premium Retail & Residential Development Opportunity in Marbella, Spain

Located in La Reserva De Marbella (Spain), this 6,350 m² shopping center is offered for €8,000,000.

Key land uses include residential (single-family, multi-family, townhouse), hotel, senior residence, retail, offices, education, and sports.

-

130 Room Hotel – Nassau Bahamas

Seeking $48M USD

King Court Hotel – Nassau, Bahamas

A 130-room hotel development located in the heart of Nassau, Bahamas. King Court will span approximately 7,500 square feet and feature extensive amenities including three restaurants, four bars, and parking for up to 300 vehicles. Designed to offer both comfort and vibrancy, the project will be a cornerstone of upscale hospitality in the region.

-

Avocado Export Facility – Peru

Seeking $7.94M USD

We are currently working with a well-established Hass avocado exporter based in Peru. The company is seeking a $7.94M USD loan secured against titled land and export receivables to support expansion of its farming and processing operations. Backed by a fiduciary trust structure through Grupo Coril, this vertically integrated operation boasts over $9M in annual sales across Europe, the U.S., and Asia.